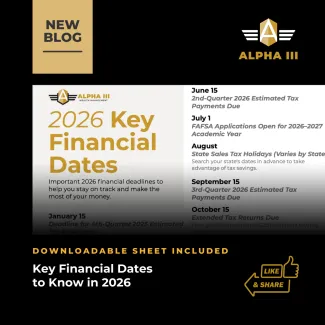

Key Financial Dates to Know in 2026

Key Financial Dates to Know in 2026

Staying on top of your finances often comes down to knowing which key deadlines can impact your taxes, retirement savings, insurance coverage, and financial aid.

Now is an ideal time to revisit your financial goals, create a plan for managing debt, and build up your emergency savings.

Below are the most important financial dates to keep on your radar for 2026. For a concise one-sheet for ease of reference, you can access here:

January 15

Deadline for 4th-Quarter 2025 Estimated Tax Payments

If you’re self-employed or receive income without withholding, such as freelance earnings, rental income, or investment income, your final estimated tax payment for the 2025 tax year is due today.

If your income shifted significantly in 2025, this is a good time to speak with your tax professional about recalibrating your quarterly payments for 2026.

Final Day for 2026 Marketplace Enrollment

Today is also the last day to enroll in or change your federal Marketplace health insurance plan for 2026. Coverage begins February 1.

After this deadline, you can only adjust your coverage if you qualify for a special enrollment period.

January 31

Organize Your Tax Forms

By today, you should receive your W-2s, certain 1099 forms, mortgage interest statements (1098), and other tax documents needed to prepare your return.

Please note that final versions/amendments of some tax forms may not be issued until mid-March, so we generally recommend waiting until mid to late March to finalize your tax filing to avoid any additional fees from your tax advisor.

Early Check-In

With the first month of 2026 behind you, this is also a good moment to check in on your financial goals.

If you planned to increase retirement contributions, boost savings, or finally build that emergency fund, now is the perfect time to get started.

March 31

Medicare Advantage Open Enrollment Ends

If you're enrolled in a Medicare Advantage Plan, today is the last day to switch to a different Advantage plan or return to Original Medicare (and join a drug plan, if needed).

April 15

Tax Day: Major Multi-Purpose Deadline

By midnight tonight, you must:

- File your 2025 federal tax return or submit Form 4868 to request a 6-month extension.

- Pay any taxes owed to avoid penalties and interest.

- Make 2025 IRA contributions (Traditional or Roth): up to the 2025 limit.

- Make 2025 HSA contributions: up to the 2025 limit.

- Make 1st-Quarter 2026 estimated tax payments if you're self-employed or pay quarterly.

Even if you file an extension, you still must pay taxes due by April 15.

June 15

2nd-Quarter 2026 Estimated Tax Payments Due

Self-employed taxpayers should make their 2026 estimated tax payments for their second quarter of the year.

This is also an ideal time for your mid-year financial checkup:

- Review income and expenses vs. your goals.

- Assess your progress toward retirement contributions or savings plans.

- Run a quick tax projection to ensure your withholding or quarterly payments are on track.

- Schedule a portfolio review to evaluate market changes and potential rebalancing.

July 1

FAFSA Opens for 2026–2027 Academic Year

If you or your child will attend college in 2026–2027, FAFSA applications can be submitted beginning today.

August 2026

State Sales Tax Holidays (Varies by State)

Many states host tax-free weekends in July or August, particularly for back-to-school purchases.

Search your state's dates in advance to take advantage of tax savings.

September 15

3rd-Quarter 2026 Estimated Tax Payments Due

Another key deadline for self-employed individuals or small business owners who pay quarterly taxes.

October 15

Extended Tax Returns Due

If you filed for an extension in April, today is your final deadline to submit your 2025 federal tax return.

Additional year-end planning notes:

- This is also the deadline for many business owners to establish and fund a SEP IRA or Solo 401(k) for the 2025 tax year (if they extended their return).

- Medicare Open Enrollment begins today and runs through December 7, 2026. This is your window to review and adjust health and drug coverage for 2027.

November 1

Health Insurance Marketplace Open Enrollment Begins

You can now enroll in, renew, or change your Marketplace health coverage for 2027.

December 2026

Year-End Financial Moves

Before the year closes, consider:

- Tax-loss harvesting if you have investments at a loss, to offset gains or reduce taxable income.

- Reviewing your charitable giving strategy.

- Checking your progress on savings or retirement contributions while there’s still time to adjust.

December 31

Required Minimum Distribution (RMD) Deadline

If you’re 73 or older in 2026, you must take your RMD from IRAs and most workplace retirement plans by today.

Other December 31 reminders:

- Last day to complete most tax-year-dependent charitable gifts.

- Last day to update beneficiaries or review your estate plan for the year.

- Final opportunity to rebalance your portfolio before the year closes.

Conclusion

Staying ahead of financial deadlines helps you avoid penalties, maximize tax advantages, and keep your financial strategy aligned with your long-term goals.

If you’d like help preparing for any of these deadlines, or want a more personalized financial calendar for 2026, our team is here to support you.